|

|

|

|

|

|

|

||

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

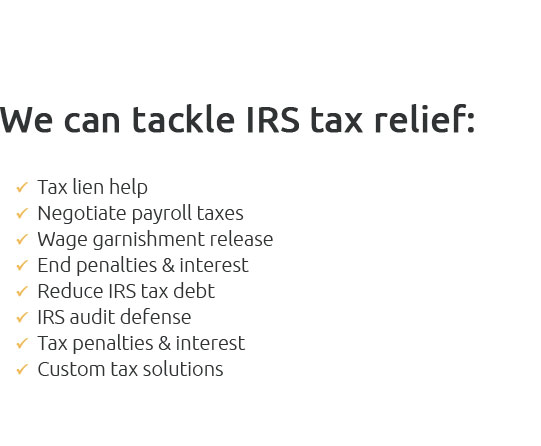

Overwhelmed by owing back taxes to the IRS and feeling like there's no way out? Our expert tax debt attorneys are here to cut through the chaos and provide the robust assistance you need to conquer your tax debt once and for all, transforming anxiety into action with a strategic, compassionate approach that’s as relentless as it is effective; we don’t just promise solutions-we deliver peace of mind, empowering you to reclaim your financial freedom and focus on the future you deserve.

https://www.irs.gov/businesses/small-businesses-self-employed/collection-process-for-taxpayers-filing-and-or-paying-late

What can the IRS do if I won't file or pay? - Enforced collection actions - Summons - Understanding a federal tax lien - Levy - Selling your property - Federal ... https://www.hrblock.com/tax-center/irs/audits-and-tax-notices/owe-the-irs-back-taxes/?srsltid=AfmBOopK1MtWvnuRJE0mhWL6txah6c4Muj81a2mqwDexv4UMo_IehRd7

1. Set up an installment agreement with the IRS. - 2. Request a short-term extension to pay the full balance. - 3. Apply for a hardship extension to pay taxes. - 4 ... https://bradfordtaxinstitute.com/Content/COVID-19-The-IRS-Goes-Easy-on-Taxpayers-Who-Owe-Back-Taxes.aspx

The IRS remains aware that substantial numbers of taxpayers cannot pay what they owe right now. To help them, it has promulgated a new Taxpayer Relief ...

|